Recently, I attended my 40-year high school reunion, and it was a blast reconnecting with old friends and playing the ‘do you remember me’ game. But the real surprise? Everyone wanted to talk about one thing—investing in Florida real estate.

From Reconnection to Real Estate

For many folks of a certain age, owning property in Florida is a dream that feels so close, but the timing has them feeling uncertain. “Should we buy now? Should we wait?” —this was the recurring question all weekend.

The Big Question: Should You Buy or Wait?

I get it—making smart decisions in the vacation home market is critical. Whether you’re buying your first vacation home or investment property, selling to maximize your return, or looking to max out your rental income, having the clearest picture of the market gives you an edge – no doubt. As someone who helps clients navigate the Florida real estate market daily, I’m here to provide the insights you need—so you can move forward with confidence.

Why Clarity is Key for Vacation Home Investors.

Let’s dive into the current trends in supply, demand, and how you can leverage them to your advantage.

Supply of Vacation Properties: A Mixed Bag Across the Emerald Coast

When it comes to real estate, it’s all about location, location, location—and nowhere is this more true than at the beach. Let’s break down how supply trends are shaping up across the region:

Destin/Miramar Beach Condos: Inventory Tightening

- YTD, condo listings are up 7.2% compared to last year.

- However, inventory has dropped in two of the last three months, indicating a tightening market.

Takeaway: Expect increasing competition for buyers as inventory tightens. If you’re selling, now might be the time to list before the supply shrinks further.

Destin/Miramar Beach Homes: Supply Shrinking

- New home listings are down 8.4% YOY across most of 2024.

- Some micro-markets may show different trends, so buyers and sellers should keep an eye on specific neighborhoods.

Takeaway: Low inventory in this area means demand could drive higher prices, especially in desirable neighborhoods.

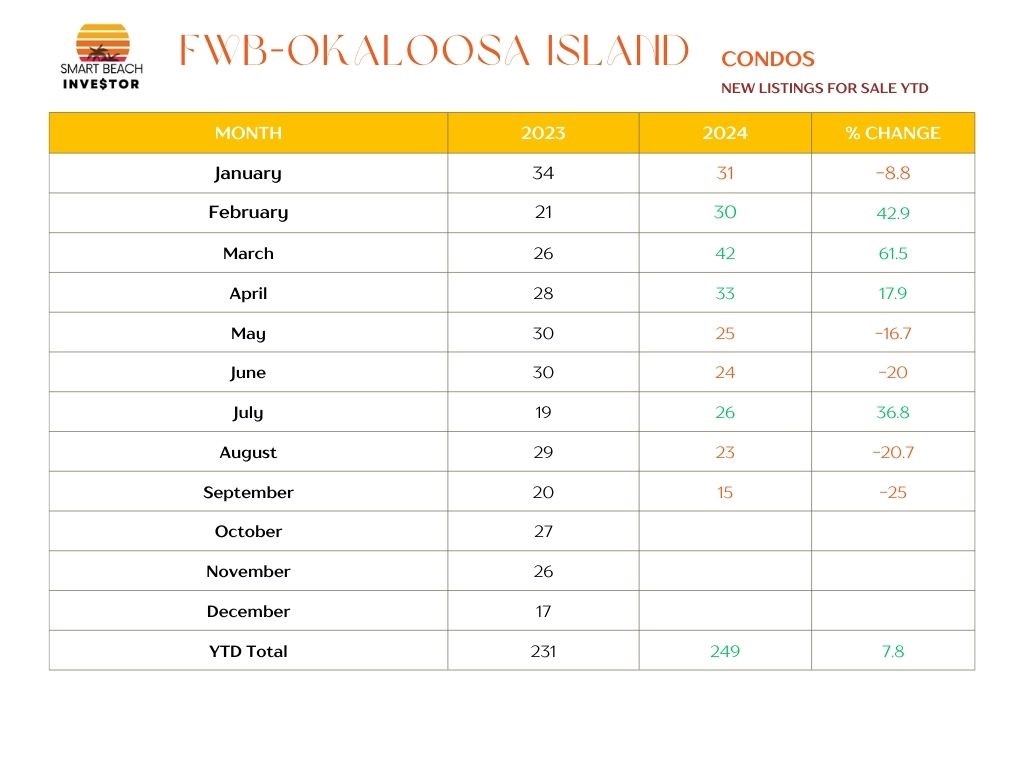

Okaloosa Island Condos: Mixed Trends

- Inventory climbed in early 2024, but has since fallen off.

- Overall supply is up 7.8% YTD, but the trend suggests a decrease going forward.

Back to the Day-to-Day Grind

Takeaway: If you’re considering buying a condo on Okaloosa Island, time may be on your side as supply increases, but don’t wait too long, as the trend may shift.

Okaloosa Island Homes: Declining Supply

- Home supply is down 9.1% YOY, similar to the condo market.

- Inventory grew in the spring but is now trending down.

Takeaway: Fewer homes are hitting the market as we move into the latter part of the year, so buyers may face fewer options.

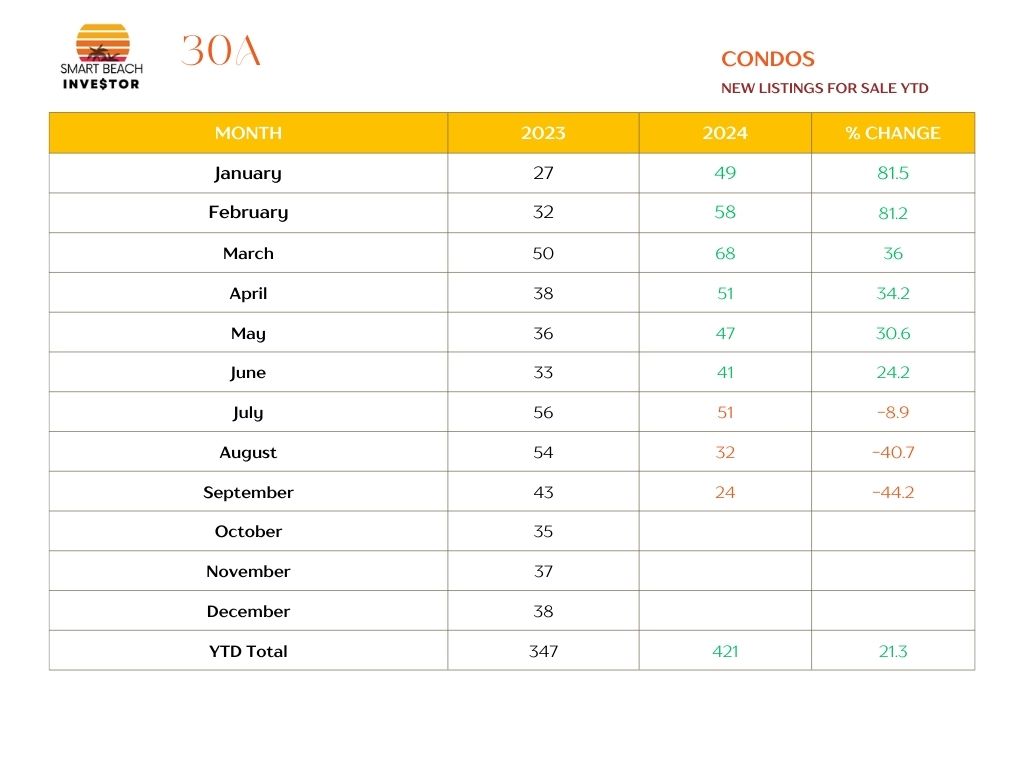

30A Condos: Strong Start, Slowing Down

Supply of new condo listings is up 14.2% YOY, but recent months show a decline in listings.

Takeaway: Early-year buyers had more options, but the window is closing. Sellers should take advantage of the current high demand.

30A Homes: Similar Supply Trends

- Listings have been up for six of the first nine months, with overall supply rising 14.2%.

- Yet, like the condo market, the last three months show a drop in new listings.

Takeaway: Supply is still strong, but it could shift quickly, so buyers should act now while options are available.

Panama City Beach Condos: Declining Inventory

- Inventory of newer condos (built after 2005) is down 1.9% YOY.

- Although the first quarter saw a rise in listings, recent months have seen a sharp drop.

Takeaway: A declining supply means condos could become harder to find, so if you’re in the market, it’s wise to act sooner rather than later.

Panama City Beach Homes: Inventory Up, but Watching Trends

Home listings are up 8.5% for the year, but recent months suggest a potential slowing trend.

Takeaway: If the recent supply increase continues, buyers will have more options, but sellers may need to adjust pricing to attract buyers.

The Demand Side: What’s Impacting Buyer Interest?

While supply gives us a glimpse of what’s available, demand tells us who’s ready to buy and at what price. And right now, demand is facing some headwinds. Rising real estate prices, increasing mortgage rates, inflation, and additional costs such as milestone inspections and HOA fees are all taking a toll on buyer enthusiasm.

Let’s break down the key factors affecting demand across Florida’s Emerald Coast:

Real Estate Prices: A Mixed Bag, But Still High Compared to Pre-Pandemic

Destin / Miramar Beach Condos:

Prices have dipped slightly, down -2.4% from $615,000 last year to $600,000 today. However, this is still a whopping 79.6% increase from the $334,000 median price in September 2019, before the pandemic-fueled price surge.

Destin / Miramar Beach Homes:

Year-to-date prices have fallen -4.9%, dropping from $1,000,000 to $950,925. Yet, even with this decline, today’s price is still 76.4% higher than the $539,000 median price in 2019.

Okaloosa Island Condos:

Prices are down -9.1% compared to last year, dropping from $550,000 to $500,000. Even with this decrease, today’s median price remains 37% higher than the $365,000 price point in 2019.

Okaloosa Island Homes:

Bucking the trend, prices are up 17.8% year-to-date, rising from $535,000 to $630,000—an impressive 44% increase from pre-pandemic prices of $435,000.

30A Condos:

Prices have seen a modest increase of 3.7%, moving from $940,000 to $975,000. This is a massive 85.7% jump from the $525,000 median price in 2019.

30A Homes:

Home prices appear to have stabilized, dropping slightly by -1.5% from $1,625,000 to $1,600,000. However, they are still up an incredible 106.9% from $773,190 in 2019.

Panama City Beach Condos:

Prices have dropped -15.8%, from $499,000 last year to $420,000 today, though this is still 55.6% higher than the $270,000 price in 2019.

Panama City Beach Homes:

Prices are down slightly by -2.9%, moving from $515,000 in 2023 to $500,000 today. Despite this dip, they are still 60.3% higher than the $312,000 median price in 2019.

Other Factors

In addition to watching price trends, several other factors are significantly influencing both buyers and sellers in today’s market. Mortgage rates, insurance costs, and structural regulations are playing a larger role than ever in determining affordability and overall market sentiment. Let’s dive into how each of these is impacting Florida’s vacation rental market:

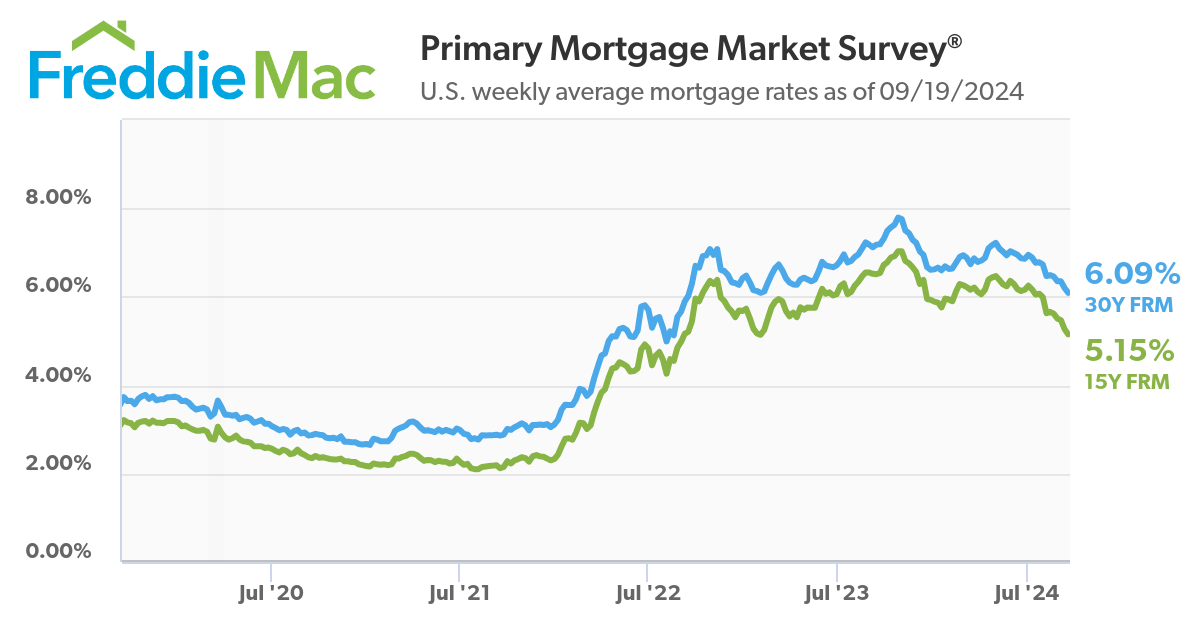

Mortgage Rates

In 2021, the weekly average for a 30-year, fixed-rate mortgage dropped to a historic low of 2.65%, making borrowing significantly cheaper. Fast forward to September 19, 2024, and the rate has more than doubled to 6.09%, putting pressure on both buyers and sellers. Higher rates mean more expensive monthly payments, which has dampened buyer enthusiasm and slowed market activity.

However, there’s good news on the horizon. The Mortgage Bankers Association (MBA) forecasts rates to gradually decline, with projections of 5.9% in 2025 and 5.5% by 2026. This anticipated decrease could ease affordability concerns and re-energize both buyers and sellers in the coming years, but the market will continue to feel the effects of today’s rates until then.

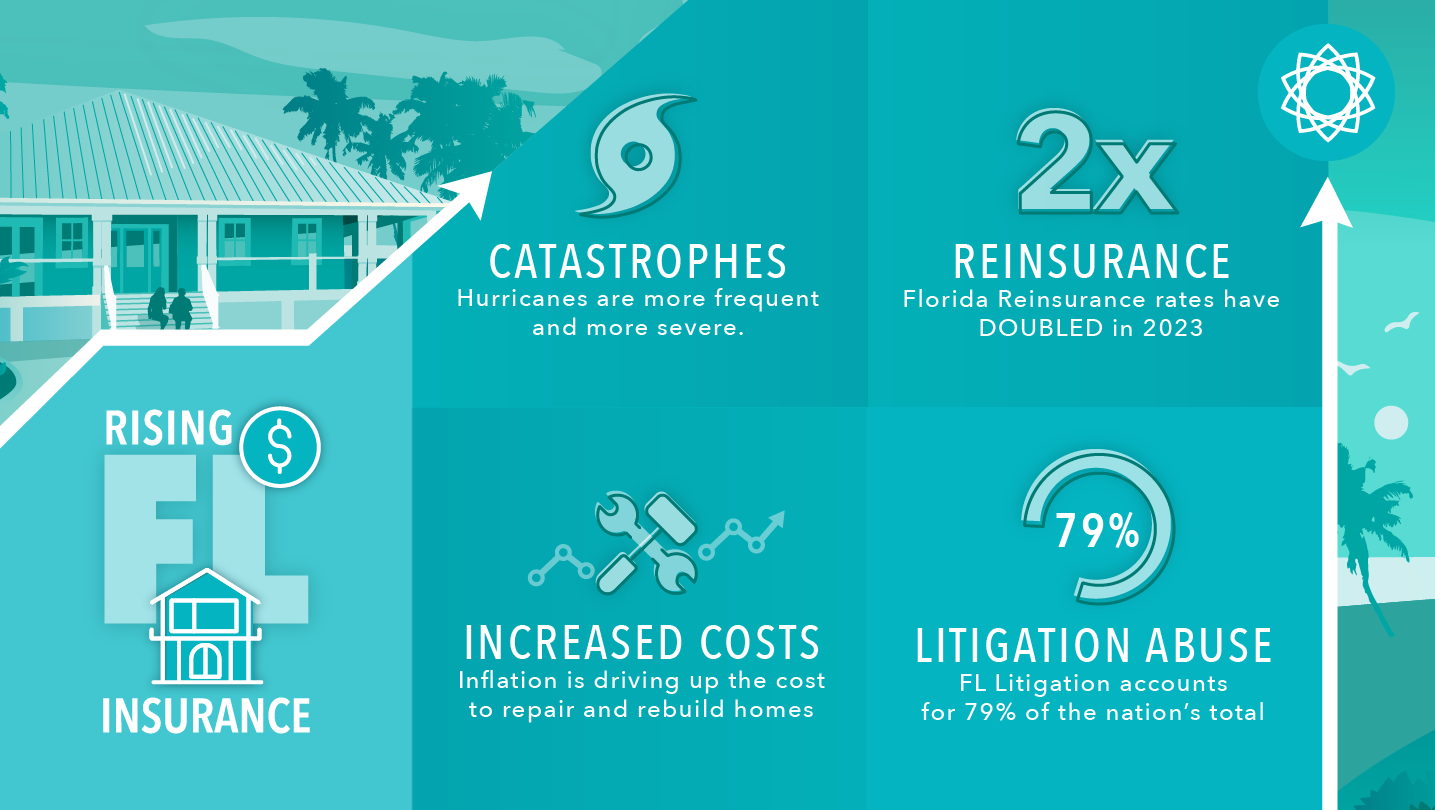

Cost of Insurance

Florida homeowners are seeing a sharp rise in insurance costs. In 2023, the average home insurance rate was $10,996, and experts predict an additional 7% increase by the end of 2024, bringing the projected average to $11,759. Unfortunately, these rising premiums show no signs of slowing, largely due to Florida’s high exposure to hurricanes and other natural disasters.

However, there may be a silver lining for vacation rental owners. If your property generates rental income, you can offset some of these costs by passing them onto renters, especially during peak seasons. While this isn’t an ideal solution, it provides a buffer that many primary homeowners—particularly condo owners in South Florida—don’t have. For those solely responsible for covering the full cost, the financial burden is considerably higher.

Milestone Inspection (SIRS) Compliance: What You Need to Know

If you’re not already familiar, the Structural Integrity Reserve Study (SIRS) mandates that all condominium buildings in Florida with three or more stories must undergo a comprehensive structural integrity assessment by December 31, 2024. After the initial review, these assessments must be repeated every 10 years. The goal is to evaluate critical components like roofs, load-bearing walls, electrical and plumbing systems, fireproofing, windows, and other vital elements that ensure the safety and longevity of the building.

The findings of these assessments can lead to significant costs, including special assessments, if major repairs are required. This could impact your financial planning, especially in older buildings where more extensive repairs may be needed.

Condominium associations are required by law to integrate the results of the SIRS into their reserve funding plans. This ensures that sufficient financial resources are allocated for necessary repairs and maintenance, both to enhance building safety and maintain compliance. Failure to complete the SIRS by the deadline could result in the board being in breach of fiduciary duty, putting the association—and potentially owners—at legal and financial risk.

If you’re not up to speed on this process, it’s essential to contact your HOA or condominium board to understand how they plan to meet the SIRS requirements. Don’t wait until the last minute—being proactive now can save you from unexpected financial burdens later.

What Does This Mean for the Market?

There seems to be a trend across the Emerald Coast: new supply typically comes on the market early in the year but then tapers off in the following months. This shift is unusual, as we generally see inventory climb after the high rental season and leading into the slower fall months.

Our daily conversations with sellers offer some insight. Many owners who were interested in selling have already done so. In fact, we’re seeing more owners choosing to let their listings expire rather than lower their asking prices or relist.

What’s left on the market tends to fall into two categories: owners attempting to capture inflated prices, and those who bought recently but aren’t seeing the returns they expected, now looking to exit the market.

The problem? There aren’t enough buyers willing to pay the current market values.

What Does The Future Hold For Florida Real Estate?

Bottom Line

For Short Term Sellers

The opportunity for short time owners considering selling in the next two years or less (I normally say five years but this feels less than that) you should sell now before prices do drop (even some).

For Long Term Holders

If you are planning to own long term (longer the better) then you may see rents fall off some over the next year or so but that is a natural cycle. Over time, you will be fine, you may even decide to buy another property if prices drop more than I expect.

For Short Term Buyers

If you are buying a condo or house at the beach the same considerations apply for you. If you are planning on buying and owning for a short while then you may want to consider not buying and simply renting. It’s a safer short term bet.

For Long Term Buyers

If you are a buy and hold investor you should start looking now, if you find a property that achieves your goals for investing buy it. Then, if mortgage rates come down you can refinance into a better deal. If they don’t, you are in at a good rate.

Pro Tip: If prices take a substantial downturn (and they could) then you need to be sure you have the liquidity to carry the property through the down cycle.

Final Thoughts

Committed to your success,

John Moran – CEO

The Smart Beach Investor | Keller Williams Realty AT THE BEACH TEAM

We Make Real Estate Easy