“Sometimes you just have to survive to fight another day” Alexandra Bracken

Over the course of my 20-year career, I’ve noticed that in hard or strange times, people tend to retreat to quality. They move to what they know to be true. They look for things they trust and feel confident in. The fact of the matter is – in strange or tough times, risky real estate falls by the wayside.

What Do I Mean By Risky Real Estate Falls By The Wayside?

In a hot market properties off the beach (considered more risky locations) can do well. They’ll capture high per night rental numbers. They’ll stay booked. They’ll appreciate at a fast rate. They’ll do all that – In a hot market. When things get strange, when money gets expensive, when everything gets tight, the risky stuff falls first, it falls faster, and fall farthest.

The bag of chips that comes with this crap sandwich is this – riskier properties also stay down longer and come back slower. In strange and tough times both buyers and renters retreat to quality and spend their money with “known” quantities.

What is a “known” quantity?

If you think about it for a minute I’m sure you will come up with the same ones I do, or at least, similar ones. Here are mine:

- Gulf Front

- Updated with Current Trends and Styles

- Great Amenities

In other words, close, new and nice.

What is the Impact on Rental Income?

We spoke to Beach Stays Vacations, a property management company, and they told us, “Properties that feel a bit “lived in”, or are ‘off the beach’ will be first to see their rental rates per night fall. If this period of strange and tough persists owners will start to see the number of nights booked drop as well.” The next step in the de-evolution of the real estate market is the ugly game of “How low will you go?” limbo will be played out. I saw this happen in the mid 2000s, even when Covid first appeared in 2020 and folks didn’t know how to react. I won’t be surprised to see it again if this year moves further toward uncertainty.

What is the Impact on Buyers?

The number of buyers will all of a sudden all but disappear and the ones that are still interested will make significantly lower offers with higher demands attached to them. We already saw this play out in 2024 with the number of transactions across the Emerald Coast fall off dramatically. Prices held up, but transactions are way down.

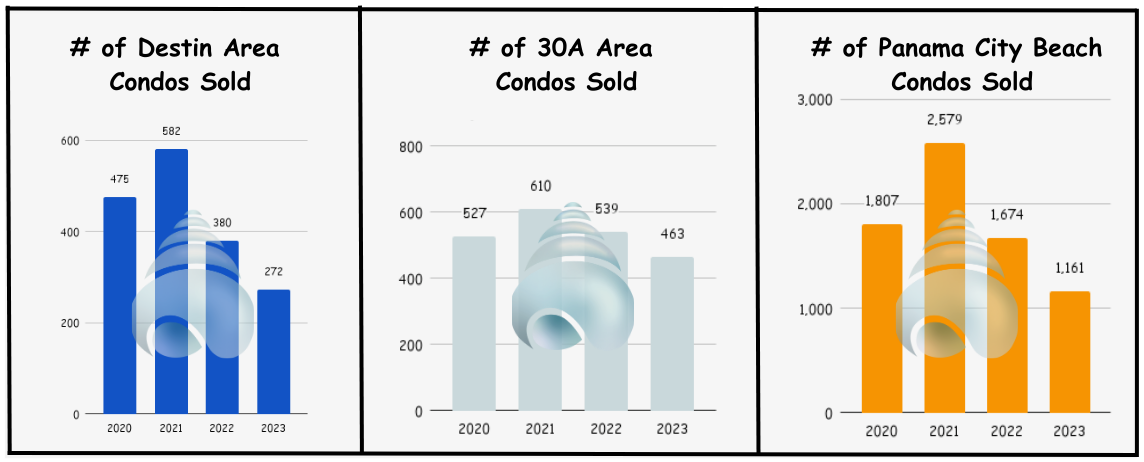

Condos Sold in Fort Walton Beach | Destin | Miramar Beach | 30A | Panama City Beach

Clearly the number of transactions have dropped for all areas of the Florida’s Emerald with regard to the condos.

Homes Sold in Fort Walton Beach | Destin | Miramar Beach | 30A | Panama City Beach

Clearly the number of transactions have dropped for all areas of the Florida’s Emerald with regard to the homes sold year over year.

Is The Real Estate Market In Strange and Risky Times?

Are we in a weird strange and hard times? Well, take a look around, what do you see? Me? All I see is weird and freaky.

Geo Politics

Russia and Ukraine, the Middle East, China and Taiwan, now Iran (or it’s proxies – what the hell does that even mean?) may be joining the chaos. Any one of these on this list screams RISKY and could cause market instability – and certainly, problems for real estate the beach depending what happens. If more than one erupts into… more… Yikes.

Prices

Prices of real estate, in many cases, doubled from 2019 to now. Great for property owners – no doubt. The weird (not so weird) thing is mortgage rates also jumped – up almost 3X – at the same time. Ouch! Wait, there’s more. Insurance is up 68% since 2021, too. What the…?

The condo that collapsed in Sunny Side is impacting all Florida condos.

A condo collapsed in Sunny Side, Florida, killing 90+ people. That was both tragic and weird. The ripple effect being felt from that disaster is a new law requiring condos with 3 floors or more above ground to conduct a Mile Stone Inspection.

If that Mile Stone Inspection finds deficiencies, they need to be addressed ASAP. The result? In some cases, massive special assessments. I’ve heard of some buildings with $100,000+ per unit special assessments. That’s a lot – and strange – therefore risky – times for Florida real estate buyers, sellers and owners.

Did I mention there’s a Presidential Election This Year?

So to answer the first question: Are we in strange and risky times? Looks like it.

How Long Will This Strange and Risky Real Estate Market Last?

The honest answer is… I don’t know. But – I do know this – nothing lasts forever (maybe well made luggage and student loan debt, but I digress) so this current state of weirdness will pass eventually. What we need to watch for are the following:

Mortgage Rates

There’s talk everywhere right now that the Fed will lower interest rates this year, maybe as soon as May. If that happens, it could signal good times are coming.

Geo Politics

If none or only – say one – of those geo political “hot spots” erupt and the others fade back to “mostly calm” that could signal good times are coming back.

Time

And you always have time acting as the great moderating force. Hold on long enough and you will see the pendulum swing back the other way.

What does the future hold for Florida Real Estate – specifically The Emerald Coast?

Strangely, this may be the easiest one to answer. Why do I say that? Throughout history the prices of real estate have gone up (not every year and every property specifically but most properties have appreciated over time) so I feel confident saying that even todays high prices will seem “cheap” in 20 or 30 years (probably sooner).

Migration Patterns – folks are coming for Florida real estate.

To feel better about future price appreciation for Florida real estate simply look at the U.S. migration trends. People in the U.S. are moving to the south – Texas, Florida, North Carolina, Tennessee, South Carolina, Arizona and Georgia. More people means more demand for housing. In the past, demand has usually caused prices of what is in demand to go up.

What Should You Do?

As we always say to investors holding Florida real estate:

Bottom Line?

Committed to your success,

John Moran – CEO

The Smart Beach Investor | Keller Williams Realty AT THE BEACH TEAM We Make Real Estate Easy.