I believe the short-term real estate market – both sales and rentals – in it’s current state is unsustainable. I would compare it to… melting ice cubes. They are there… but… if you are going to sell – don’t wait too long.

Long Term Outlook

With regard to owning real estate here at the beach for the long-term… I’m all in. I’m an absolute buyer. Why? I think Florida is perfectly positioned to reap the rewards that come from the following trends:

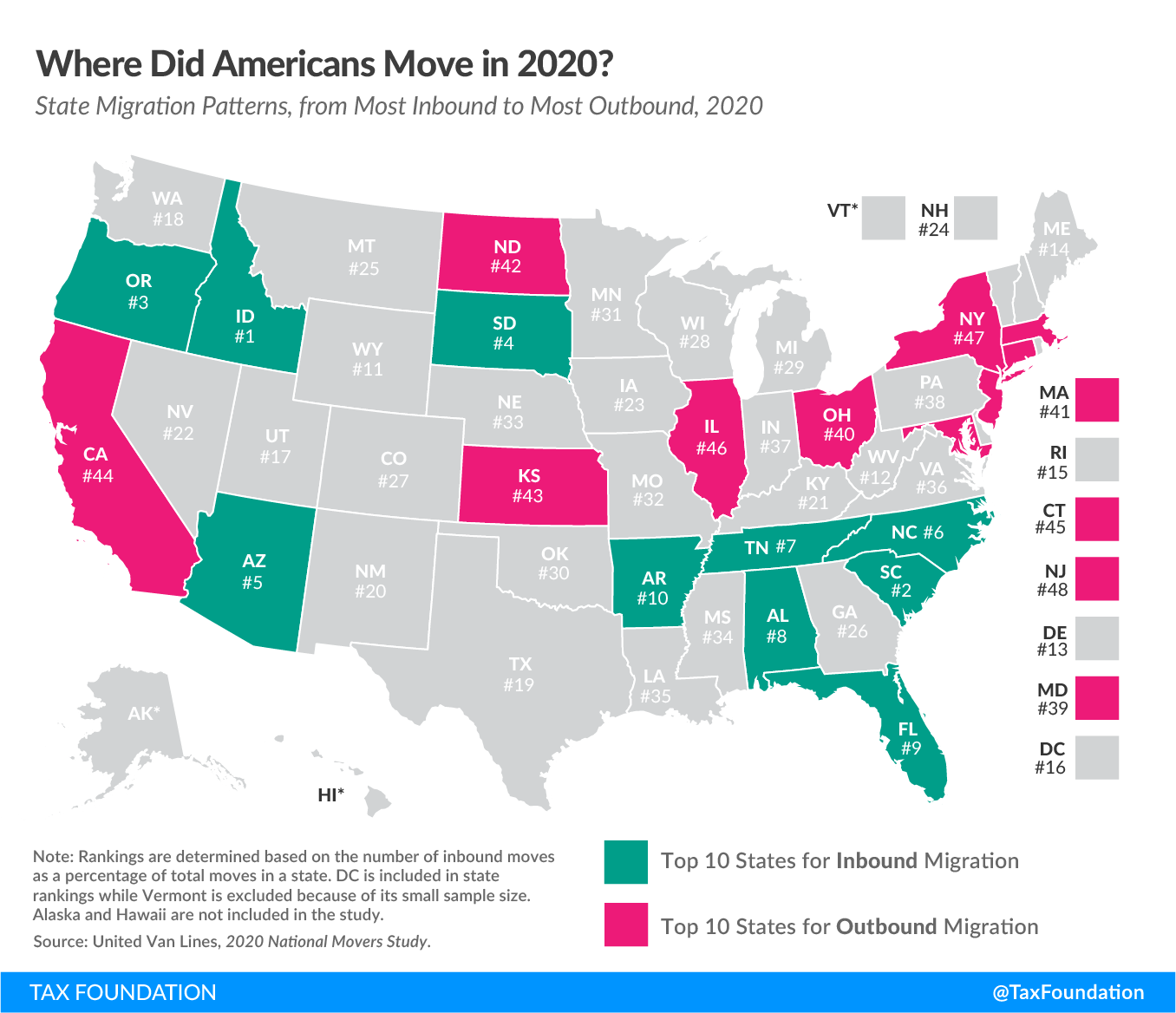

Population Shift

People have been moving from the northern states to the southern states for years and it’s only picking up steam. According to the U.S. Census Bureau, California, New York, New Jersey, Michigan, and Illinois lost a combined 4 million residents between 2010 and 2019. On the other side are the states of Florida, Texas, Tennessee, Ohio, and Arizona where they have seen population gains.

It makes sense, the weather here is better, the crime is less, the cost to buy a home is less here than in many metropolitan areas, and the business environment (no state income tax) is generally seen as better by a lot of people. All this is good news for people who own or are planing on investing in real estate here at the beach and plan to hold it for a while.

Remote Work

I think the pandemic has accelerated the notion that folks can effectively telecommute to work via Zoom or something like it while living at the beach. The ability to work remotely now allows people to live here and travel to the office as needed – rather than the other way around.

Retail giant REI has jumped on this in a big way. “We believe the future of work is much more fluid,” says Chris Putur, REI’s executive vice president of technology and operations. “We’re building the future around the work that needs to get done, and creating flexible, agile and inclusive ways to deliver innovation for our customers – and we no longer believe we need a traditional office model to do so.” Granted they were headquartered in the Seattle area and are perhaps a bit more progressive that we are here in NW Florida but I’m seeing this kind of thinking here as well.

In our main Destin office, fewer people are showing up on a daily basis and it’s not because they aren’t working – they are – a number of them are having their best years ever. When asked, why aren’t you coming to the office on a regular basis? The answers were: “I’m worried about Covid”, “I don’t want to fight the traffic – especially in the summer.” and, “I don’t need to.” All are valid reasons – no doubt.

I’m curious though if examples like our office and REI continue to play out across the country or if they end up as short lived experiments. Like everything, the answer is probably somewhere in the middle, some sort of flex schedule.

If you could live at the beach, work from your home, jump on a Zoom call with your group once a day, and travel to HQ once a month for a few days… wouldn’t you sign up for that program? Or at least invest in a condo or house at the beach that you could use whenever you wanted and rent it when you’re not using it?

The Airbnb Effect

I think the market for vacation rentals is only going to get stronger as time and technology move forward. More people are becoming more comfortable with renting through portals like Airbnb, VRBO, Vacasa, and the smaller rental management companies that serve our market. As more and more people put their properties into the system I believe we will see people moving away from the traditional hotel/motel model like they moved away from corporate owned taxies toward privately owned Uber drivers.

Additionally, these companies are getting more organized, more established and they are spending more marketing dollars promoting properties to potential renters which will bring new visitors and their dollars to our area. All good for the long-term outlook.

But… Don’t forget about the melting ice cube.

The Short Term Outlook

There is a three headed monster looking to take a bite out of the short-term real estate sales and rental markets.

Affordability.

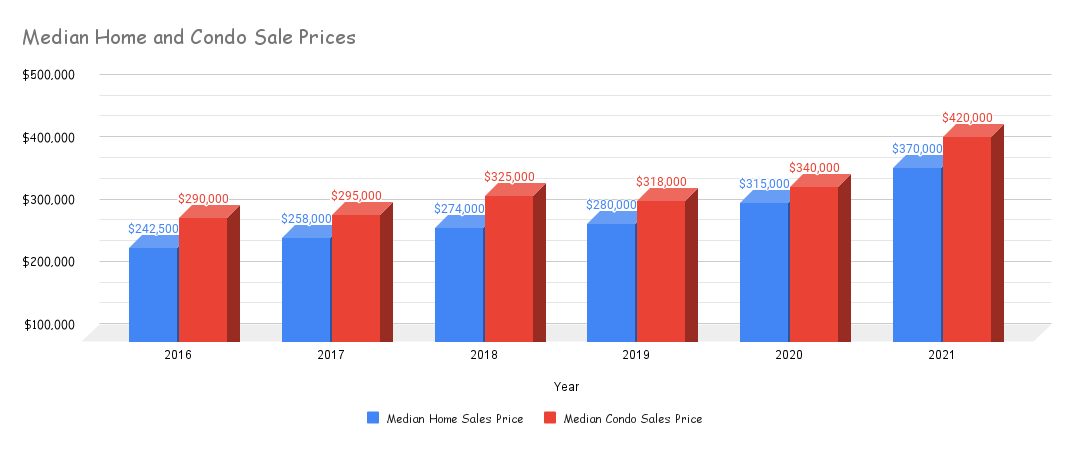

The cost of homes in our area has jumped dramatically over the last ten years and especially over the last two. Home prices across the Emerald Coast have shot up 31.4% over the last two years to about $370,000. Condos are up even more +33.3% to about $420,000.

That is great for owners, but it also serves as a governor on affordability because these high prices are forcing buyers to take out bigger loans thus cancelling out the benefit of the low interest rates. And that’s a problem for folks looking to sell at high prices in the short-term.

Tax Implications with the $3.5 Trillion Social Policy Plan.

There is a big push for a bunch of new social programs and it’s going to cost a lot of money. Where is the government going to get the money? From people with… money (the rich). People like those who own real estate at the beach. People like you.

As reported in Forbes – The House Ways & Means Committee has released draft legislation of individual tax hikes they propose to pay for plan. Included in the plan are major revisions to the estate tax, capital gains taxes and the way retirement accounts are taxed.

Who’s rich for purposes of this legislation? In most cases, it’s a married couple with income over $450,000, singles with income over $400,000. But beneficiaries of trusts and estates (that can be a special-needs child) would also feel the pain as trusts and estates would face the new top income tax rate of 39.6% at just $12,500 of income.

Bottom line: Everyone needs to pay attention.

Vulnerable Rental Income.

Over the last two years we have seen rental income jump dramatically as demand for accessible vacation destinations spiked. Can this last? I asked John Skinner, a Senior Realtor on Keller Williams Realty At The Beach Team specializing in the sales of gulf front condos in Panama City Beach, what he is seeing with regard to rental income and if owners can expect to continue capturing the great rents they’ve seen over the last two years? His response was, “I don’t think so, the great rental income we’ve seen is from a lot of people coming down and benefiting from loose work schedules, stimulus money, and mortgage deferrals that will continue to come to an end. It is probably unsustainable.”

Another angle we are watching with regard to rentals is what the impact of cities, cruises and out of country travel opening up? We have had the benefit of a shift toward destination/resort markets like ours for the last two years and probably the next one or probably two, but will that continue in 2022 as demand returns to cities, cruises and out of country travel? Hard to say, but it does create some short term vulnerably for sure.

What should you do? What should you do?

Our recommendation has always been and continues to be rooted in our foundational belief that our mission is to help you maximize your position as an owner, seller or buyer based on your financial goals and the current market conditions. With this in mind we lean heavily on the following:

Seller – Long Term Holder:

If you are planning to own your property for five years or more, sit back and watch what happens to prices. If they go up – you win. If they correct, that alright too, because you have time to let them correct and then come back even higher. In other words – you win. In the meantime – you may want to explore how to max out your rental income so that:

- Leverage the tax benefits of owning investment real estate.

2. You capture and keep more dollars while you own.

3. When you do decide to sell, we can get you a higher sales price and a faster sale.

Call us if you want to look at how to max out your position as an investor of real estate at the beach.

Seller – Short Term Holder:

If you are planning on selling within the next 1-5 years, we recommend that you sell now while we know you can get a great price. As we demonstrated at the beginning of this update, things can and do change… fast. If you are a short time player, take the sure thing and mitigate your risk of bad changes by securing a high price today.

Buyer – Long Term Holder:

If you are planning on buying a place here at the beach and plan to hold it for at least five years – longer the better – buy today. Mitigate your risk of prices jumping, of mortgage rates jumping, of… who knows what? Find your place now, lock in your crazy low mortgage rate, and then sit back and watch as prices appreciate over time.

Buyer – Short Term Flipper:

Buying high and selling higher is a risky game to play. But there are people that have been able to make it work in a big way. If you want to do this, let us know and we can help you find those properties that were priced below market, or the seller needs to move the property quickly and will sell at a discount, or for… pick a reason? There aren’t many sellers in this position these days but there are always some. So again, if you want to look at flipping a property, just give us a call at 850-654-3325 and we will be happy to help you find one.

Bottom Line?

We have been fortunate enough to have helped a lot of people like you own, buy, and sell properties here at the beach for years and years. As a matter of fact, we’ve helped more than 200 people buy or sell this year alone.

Always Know:

Our goal (whether you are buying or selling) is to get you the best deal possible so call us today at 850-654-3325 and let’s talk about how you can get a max deal here at the beach.

Committed to your success,

John Moran – CEO

AT THE BEACH TEAM

Certified Luxury Home and Condo Marketing Specialists

Keller Williams Realty Emerald Coast