We are living in peculiar times. With the ongoing war in Ukraine, the turmoil in the Middle East, and the potential developments in Taiwan with China, there is a lot happening on the global stage. Geopolitics, oil, and political instability all appear to be working together to create a scenario where inflation may not be brought under control, resulting in higher mortgage rates among other things. Instead of lower inflation, we might be facing hyperinflation, a level of inflation reminiscent of the 1970s.

The elephant in the room… oil.

Oil is essential for a wide range of purposes: it serves as fuel for ships, planes, trains, and automobiles. It is used to create the asphalt that paves our roads and is found in many everyday products and services. Virtually anything made of plastic, rubber, or other synthetic materials relies on oil.

If a geopolitical crisis were to disrupt oil production and distribution, we should expect prices to skyrocket, impacting everything, including real estate near the coast.

The Effect of Higher Oil Prices

It’s commonly stated that oil affects the price of everything, but let me break it down for you quickly. Here’s a brief overview of the impact across various sectors:

Consumers (you and me): We will experience higher prices at the gas pump and in stores, leading to a decrease in our living standards. From my perspective, that doesn’t sound great.

Inflation: If the cost of production and transportation increases, prices are likely to surge significantly. It’s a straightforward consequence.

Current Account: Oil-importing countries will face a larger current deficit. When you can’t access oil due to other countries refusing to sell it to you, that becomes a significant issue.

Long-term incentives: Perhaps we’ll eventually see the development of green energy solutions, but that’s not likely to happen anytime soon.

Alternatives: Consumers might consider switching to alternatives like electric cars, reducing travel, or downsizing their homes. It’s a possibility.

Investments: Buyers, builders, and developers are likely to scale back their activities, leading to a more substantial deficit in the housing market.

Economic Growth: Expect an overall slowdown in economic growth.

All of this makes sense, and none of it bodes well for lower prices on anything.

Why is Oil Even a Thing?

If you examine the world’s leading oil producers, you’ll notice that we are currently engaged in proxy conflicts with two of them, and our relationships with several others are strained. In the grand scheme of things, if a conflict were to erupt in the Middle East and we face challenges with Russia and China, it could lead to a significant increase in oil prices, subsequently affecting the prices of everything, including mortgages and beachfront real estate.

Does this sound familiar?

War in the Middle East? During the 1973 Arab-Israeli War, Arab members of the Organization of Petroleum Exporting Countries (OPEC) imposed an embargo against the United States in retaliation for the U.S. decision to resupply the Israeli military and to gain leverage in the post-war peace negotiations. Does that sound familiar? Here we are in 2023, with U.S. military ships positioned around Israel to provide military support.

If you’re over 50 years old, you likely remember the gas lines of the 1970s. The 1970s are interesting because there are many similarities to the present day.

Mortgage Rates

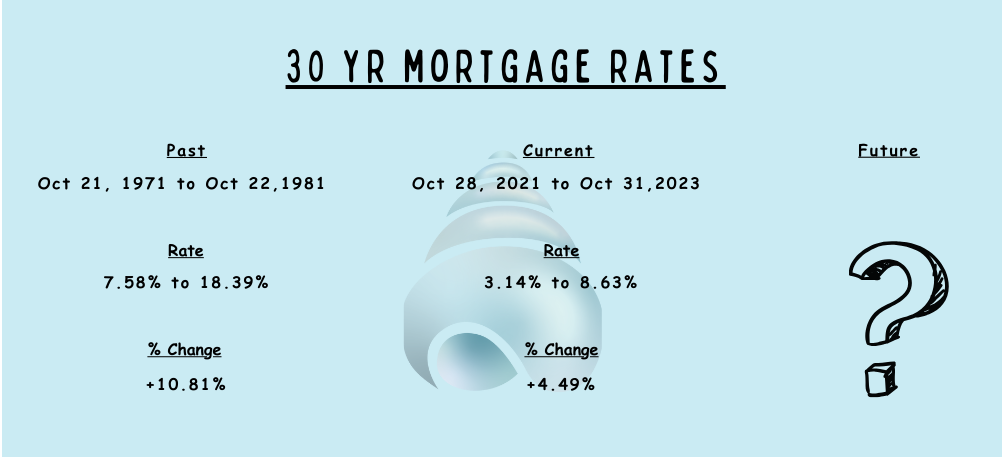

Also in the 70’s we saw mortgage rise dramatically as the Federal Reserve tried to stop persistent inflation. Take a look at this graphic. Mortgage jumped from 7.58% in Oct of 1971 to 18.39% in Oct. 1981. Now they are jumping again. Conclusion? Clearly mortgage rates can go up and have been higher than today’s seemingly high rates. Why did they go so high in the 70’s? To break inflation. Sound familiar?

The question then is, what did the high interest rates do to the price of homes? Surly they came down.

Home Prices

This is interesting. In 1971 Qr the median sales price for a home in the U.S. was $25,500 and the mortgage rate was 7.58%. By the end of the decade the median sales price for a single family home in the U.S. had almost tripled to $70,400. Mortgage rates nearly did as well as they climbed from 7.58% to 18.39%! Conclusion. A high mortgage rate does not necessarily mean that home prices will come down. Heck, they could even go up, as we saw in the 70s.

Prices, as always, are most impacted by supply and demand. If the supply is a lot, generally prices come down. If the supply is limited and demand is strong, then prices generally go up.

Summary

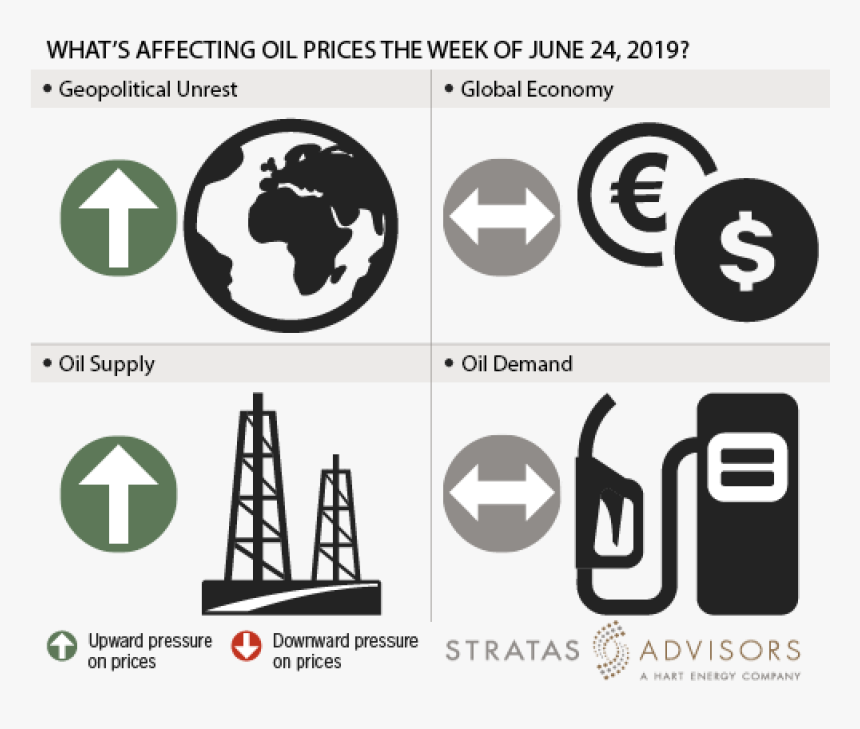

Let’s quickly examine what is likely to affect our real estate market in the upcoming weeks, months, and possibly beyond. This graphic focuses on oil, but I believe it can be connected to everything, including beachfront real estate.

What will affect real estate prices?

-

Geopolitical Unrest: Geopolitical instability is prevalent. The Middle East is in turmoil, Russia and Ukraine are facing challenges, tensions persist between China and Taiwan, and there are issues at the southern border.

-

Oil Supply: Oil-related problems abound. We are currently involved in proxy wars or experiencing various levels of discord with many of the world’s largest oil-producing countries. Additionally, our current political leadership is considering restrictions on oil production and refining in the U.S.

-

Global Economy: As per the IMF Blog, the latest projections indicate a slowdown in global economic growth, with estimates falling from 3.5 percent in 2022 to 3 percent this year and 2.9 percent next year. This represents a 0.1 percentage point downgrade for 2024 compared to July figures, and it remains well below the historical average.

-

Oil Demand: Oil demand continues to be very high, and a swift transition to alternative energy sources is unlikely.

All four of these aspects indicate a strong likelihood of rising prices in the coming months and potentially years. We will closely monitor these developments.

Should you Buy, Sell or Hold?

The honest answer is… it depends.

Hold: If you are a long term holder then by all means hold on. Markets cycle and this one appears to be as well. You may even start looking ahead to determine if you are a potential buyer if prices get low enough.

Sell: If you are not planning to own for the next 5 years at least you should take a hard look at selling now while prices are still pretty high. Prices may not be all time highs anymore but they are still pretty high. Why risk prices dropping dramatically if you don’t have to? Send an email to info@smartbeachinvestor.com if you would like information on how to sell and capture a still high price.

Buy: If you are buying because you want a place at the beach and you can afford it – buy. Use your new property to make memories with your family and friends. If you are an investor that doesn’t care about using it or having a place at the beach, you are simply interested in a max return – you may want to wait a bit and see what happens. If you are someone that wants a place and is fine sharing with renters and collecting rental income to offset the costs to own – go for it. You can still buy a place, use it some and rent it enough such that it is no cost or only a low cost for you to own, creating a situation where you end up owning a property at the beach free of charge. Send an email to info@smartbeachinvestor.com if you would like information on how to best invest in a property here at the beach.

What Should You Do?

We are wealth builders, so our goal (whether you are buying or selling) is to build or protect your wealth – based on your financial goals and the current market conditions. Call us today and lets talk about how you can max out your position as a buyer, a seller or as an owner to continue building your family’s wealth well into the future.

Committed to your success,

John Moran – CEO

The Smart Beach Investor | Keller Williams Realty AT THE BEACH TEAM We Make Real Estate Easy.